TOKEN REALTY EXCHANGE

Democratizing Real Estate Investment Through Blockchain Technology

Executive Summary

🚀 Investment Opportunity: $2,000,000 Seed Round

Pre-Money Valuation: $10,000,000 | Equity Offered: 16.67%

Status: Working product, ready to scale | Capital Use: Team scaling & market expansion

🚀 THE EXPONENTIAL GROWTH ENGINE: Broker Leverage Model

Why We'll Scale Faster Than Any Competitor:

- Zero cost to join - Brokers use platform for free

- Majority profit share - Brokers keep most of the revenue

- Instant customer base - Each broker brings 100-500 existing clients

- Pre-built trust - Clients already trust their broker

- Exponential scaling - 1 broker = 500 clients instantly

- Training pipeline - School creates 4,000+ certified professionals/year

Result: While competitors acquire customers one-by-one (CAC: $500-2,000), we acquire ONE broker and get 500 customers instantly (CAC: $10,000 ÷ 500 = $20/customer)

The Opportunity

Tokenizing the $60 trillion U.S. real estate market with the first fully SEC/CFTC compliant platform for both public commodity tokens and private equity offerings.

First-to-Market Advantage

Only platform offering dual-market (public commodity + private equity) tokenization while cutting in licensed brokers with a lucrative profit-sharing model.

Key Highlights

Why Now?

- Regulatory Clarity: SEC/CFTC frameworks now enable compliant real estate tokenization

- Market Demand: $10T+ in illiquid home equity seeking liquidity solutions

- Broker Adoption: 2M+ licensed brokers looking for new revenue streams

- Technology Maturity: Blockchain infrastructure now stable and scalable

- Qualified Opportunity Zones: $6T in potential tax-advantaged investments

Problem & Market Opportunity

The $60 Trillion Problem

💰 Trapped Equity

$10T+ in illiquid home equity that property owners cannot access without selling or taking traditional loans at high interest rates.

🚫 Broker Exclusion

Current tokenization platforms cut out 2M+ licensed brokers, missing the largest distribution channel in real estate.

⚖️ Regulatory Risk

Existing platforms operate in regulatory gray areas, exposing investors to compliance risks and potential shutdowns.

🔒 Accredited-Only Access

Private equity real estate locked to accredited investors, excluding 90% of potential participants.

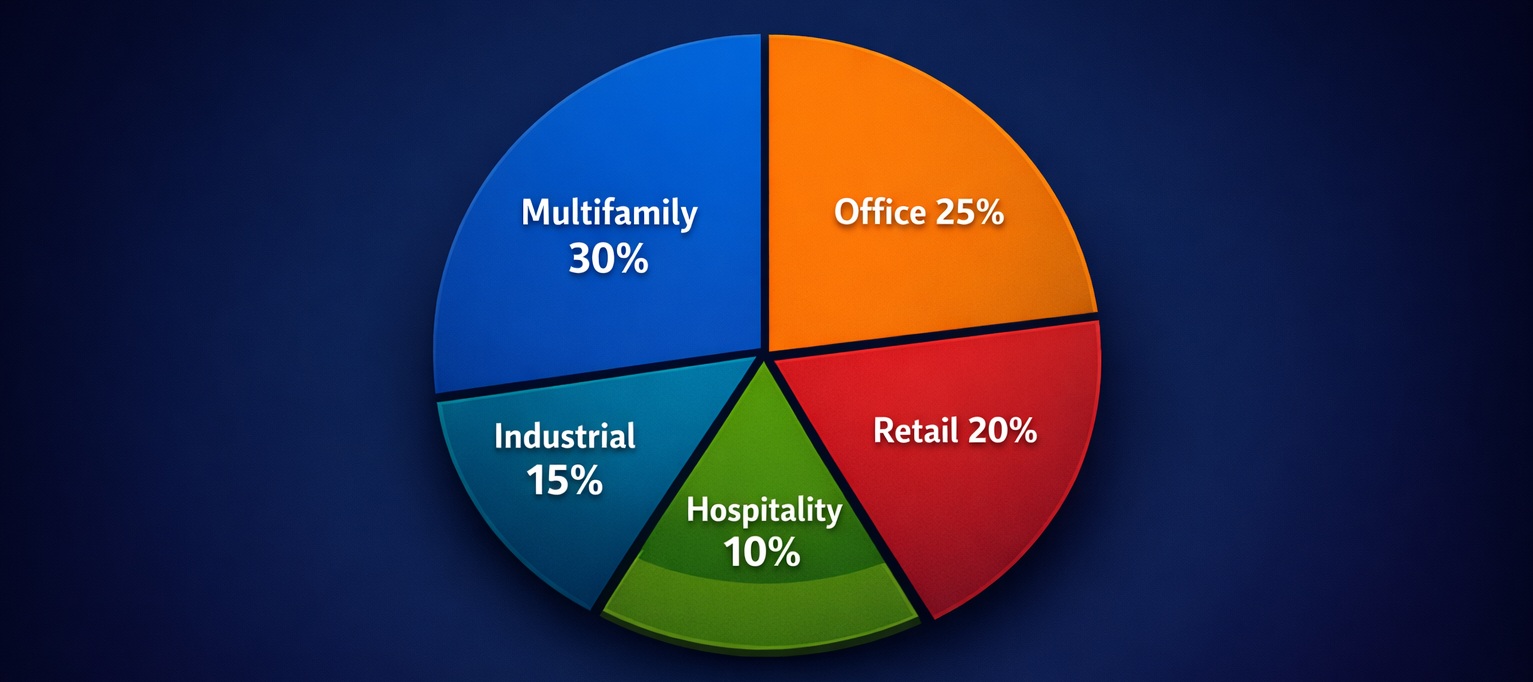

Market Opportunity

| Market Segment | Total Value | TRE Addressable | Opportunity |

|---|---|---|---|

| Residential Real Estate | $43.4 Trillion | $4.3 Trillion (10%) | Public commodity tokens |

| Commercial Real Estate | $20.7 Trillion | $2.1 Trillion (10%) | PE funds & fractional |

| Private Equity Funds | $1.5 Trillion | $750 Billion (50%) | Fund tokenization |

| Total Addressable Market | $65.6 Trillion | $7.15 Trillion | 11% capture rate |

🎯 Our Target: Conservative 1% Market Penetration = $71.5B Annual Volume

At 0.85% average platform fee, this generates $608M in annual revenue from tokenization alone (excludes trading, listing, and licensee fees).

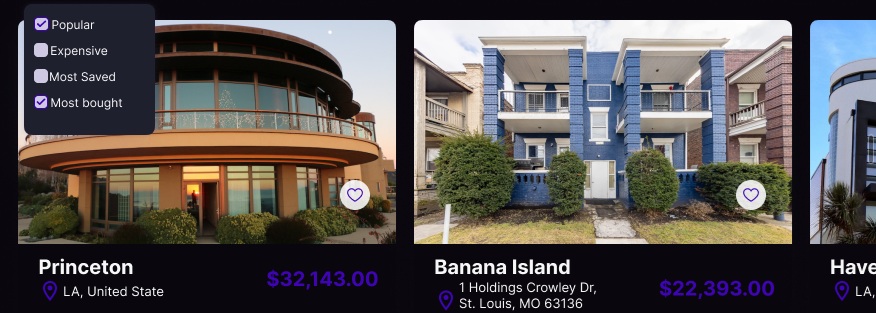

The Token Realty Exchange Solution

Dual-Market Platform

Public Commodity Market

- AVM-driven property index tokens

- No human management = commodity status

- Accessible to all investors (non-securities)

- Regional & state diversification indexes

- Market exposure from $100 (location-based index positions, not ownership)

Private Equity Market

- Reg D/S compliant offerings

- Whole property fractional ownership

- PE fund tokenization

- Business equity offerings

- Qualified Opportunity Fund structure

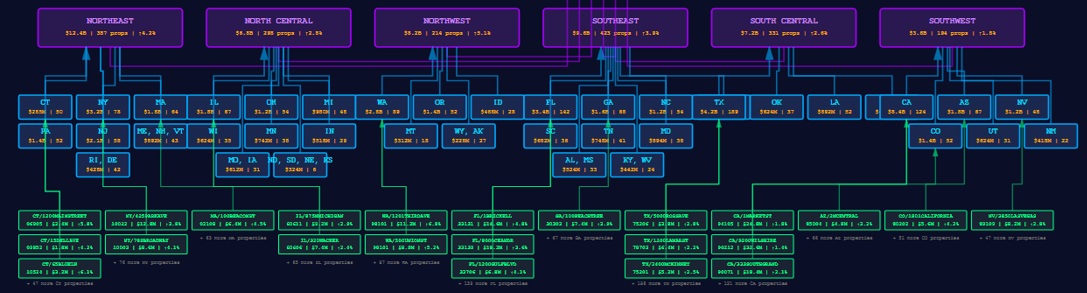

Revolutionary Property Market Index System

🎨 Patent-Pending Innovation: Commodity Property Tokens

We invented the first AVM-driven property market indexes that aggregate values across regions and states, offering location-based market exposure classified as commodities (not securities) because:

- Zero human discretion in pricing (100% algorithmic AVM)

- No active management of underlying assets

- Purely market-driven value fluctuations

- Does not meet 4 prongs of Howey Test (not a security)

How It Works

Step 1: Property Owner Application

Owner submits property for tokenization through licensed broker. AVM determines fair market value. Owner retains ownership while accessing equity.

Step 2: Token Creation & Compliance

Platform generates tokens (commodity or security based on structure). All regulatory filings automated. Smart contracts handle distribution.

Step 3: Market Listing

Tokens listed on TRE exchange. Public commodity tokens available to all. PE offerings restricted to accredited investors per Reg D.

Step 4: Trading & Liquidity

Secondary market trading provides liquidity. Automated yield distribution. Tax reporting via 1099/K-1.

Step 5: Ongoing Management

Quarterly AVM updates for commodity tokens. Property management through trusted partners. Automated compliance monitoring.

Why We Win: Unmatched Competitive Advantages

🏆 #1 Advantage: Broker Leverage = 25-100x More Efficient Growth

While every competitor acquires customers one-by-one, we acquire entire customer bases by partnering with licensed brokers who bring 300+ existing clients instantly.

Competitors:

- Direct-to-consumer model

- $500-2,000 CAC per customer

- Linear growth

- Cut brokers OUT

TRE:

- Broker partnership model

- $20 CAC per customer (via broker)

- Exponential growth

- Empower brokers WITH majority profit share

1. Only Broker-Inclusive Model

The game-changer: 2M+ licensed professionals become our distribution force. Each brings 300+ clients. Zero cost to join. Majority profit share. Result: Exponential scaling impossible for competitors to match.

2. First Fully Compliant

SEC/CFTC compliant from day one. Only platform with proper commodity classification for public tokens AND Reg D/S infrastructure for PE offerings. 2-3 year regulatory moat.

3. Dual-Market Innovation

Unique dual offering: Public commodities + Private equity. Invented AVM-driven property indexes (patent-pending). Competitors choose one or operate non-compliantly.

Competitive Landscape

| Feature | TRE | RealT | Lofty | Slice | Traditional REITs |

|---|---|---|---|---|---|

| Broker Integration & Profit Share | ✅ Full partnership + majority share | ❌ No broker program | ❌ No broker program | ❌ No broker program | ⚠️ Limited (traditional model) |

| Cost to Brokers/Users | ✅ $0 - Completely free | N/A - Direct to consumer | N/A - Direct to consumer | N/A - Direct to consumer | Traditional fees |

| Distribution Model | ✅ Exponential (brokers × clients) | Linear (D2C marketing) | Linear (D2C marketing) | Linear (D2C marketing) | Linear (traditional sales) |

| SEC/CFTC Compliant | ✅ Full | ⚠️ Partial | ⚠️ Partial | ⚠️ Gray area | ✅ Full |

| Public Commodity Tokens | ✅ Yes (AVM-driven) | ❌ No | ❌ No | ❌ No | ❌ No |

| Private Equity Market | ✅ Yes | ✅ Yes | ❌ No | ✅ Yes | ❌ No |

| Training/Certification Program | ✅ Yes - 4,000+ graduates/year | ❌ No | ❌ No | ❌ No | ❌ No |

| Minimum Investment | $100 | $50-100 | $50 | $10,000 | ~$25 |

| Liquidity | ✅ Secondary market | ⚠️ Limited | ⚠️ Limited | ❌ Lock-up periods | ✅ Stock market |

| Geographic Coverage | All 50 states | Select states | Select states | Select cities | National |

| Blue Sky Filings | ✅ All states | ⚠️ Partial | ⚠️ Partial | ❌ Minimal | ✅ Full |

Yellow highlighted rows = Our killer advantages that create winner-take-all dynamics

🏆 The Blockbuster Moment for Real Estate: Empowering Brokers, Not Replacing Them

This is to real estate what Spotify was to music and Netflix was to video—but with a critical difference: We're empowering the existing industry players, not disrupting them.

Why Brokers Embrace TRE (Instead of Fighting It):

- We're NOT replacing brokers - We're making them 10x more profitable

- Zero cannibalization - This is NEW revenue on top of existing commissions

- Majority profit share - They keep most of the money, not us

- Zero cost to participate - No risk, pure upside

- Leverages existing relationships - Their clients already trust them

- Professional development - Certification school adds credibility

Result: Solving the problem in a decentralized, broker-centric manner that benefits ALL stakeholders:

- Property owners access trapped equity without selling

- Brokers earn $858K+ annually (10x current income)

- Agents add $200-250K per year in passive income

- Sales Managers earn $500K+ annually

- Investors access fractional real estate from $100

- Platform generates massive transaction volumes

This isn't disruption—it's elevation. We're making everyone richer.

The Broker Leverage Model: Our Secret Weapon

💎 The Math That Changes Everything

TRE Platform: Acquire 1 broker = 500 customers instantly (CAC: $10,000 ÷ 500 = $20/customer)

Result: 25-100x more efficient customer acquisition than competitors

Why Brokers Join TRE (And Bring Their Entire Book of Business)

1. Majority Profit Share from Day One

Unlike competitors who keep 100% of fees, we share the majority of revenue with brokers immediately:

- Broker gets direct platform revenue share

- No waiting for commissions

- Transparent, real-time earnings tracking

- Average broker: $858,000/year

- 10x their current real estate income

2. Zero Cost to Join & Use

Brokers use the platform completely free:

- No monthly subscription fees

- No per-transaction fees

- No setup costs

- No software licensing

- Pure profit from day one

The Exponential Growth Multiplier

| Asset Each Broker Brings | Value to TRE | Why It Matters |

|---|---|---|

| 100-500 Existing Clients | Instant customer base | Each broker = 300x customer multiplier (avg 300 clients) |

| Pre-Built Trust Relationships | Zero trust-building time | Clients already trust their broker = immediate conversions |

| Licensed & Compliant | Regulatory credibility | 2M+ licensed professionals = built-in compliance layer |

| Local Market Knowledge | Geographic expansion | Brokers know their markets = perfect property sourcing |

| Existing Marketing Channels | Free distribution | Brokers already market to their database |

Why NO Other Platform Does This

RealT, Lofty, Slice

Direct-to-Consumer Model

- Acquire each customer individually

- High marketing costs ($500-2,000 CAC)

- Slow, linear growth

- No broker relationships

- Cut brokers OUT completely

Traditional Brokerages

Keep 100% Revenue Model

- If they tokenize, keep all fees

- No incentive for broker to promote

- Brokers are employees, not partners

- Slow internal adoption

- Traditional brokerage mindset

Token Realty Exchange

Broker Partnership Model

- Brokers as distribution partners

- Majority profit share incentive

- Zero cost = zero barrier to entry

- Brings entire client book

- Win-win-win for everyone

🎯 The Network Effect in Action

Year 1: 979 brokers × 300 clients each = 293,700 potential customers

Year 3: 6,941 brokers × 300 clients each = 2,082,300 potential customers

Each new broker doesn't just add themselves—they add their entire network. This creates exponential, not linear, growth.

The Training School Multiplier

Creates PE Deal Flow (Not Brokers)

TRE Certification School produces Managing Partners:

- 4,032 certified graduates per year (Year 3)

- 15% become Managing Partners = 605 new MPs/year

- MPs trained to: find RE deals, structure PE offerings, start funds

- Platform streamlines PE structuring process

- Creates SUPPLY of PE investment opportunities

Brokers Create Distribution (Already Licensed)

Brokers need zero training from us:

- 2M+ licensed brokers already exist in U.S.

- Brokers bring existing client relationships

- Zero cost to join platform

- Can become LICENSEES to build broker teams

- Creates DEMAND through investor distribution

💎 The Perfect Ecosystem Loop

School-trained MPs create PE deals → Licensed brokers sell them to investors → More deals = more broker income → Brokers recruit more brokers → More distribution → MPs create more deals

SUPPLY (MPs) + DEMAND (Brokers) = Exponential growth on both sides of marketplace

The Licensee Broker Model: Building Teams

🏢 Two Ways to Participate: Standard Broker vs Licensee Broker

Standard Broker (FREE)

- Zero cost to join

- Bring existing clients

- Earn revenue share on deals

- Average: $858K/year

Licensee Broker (State Auction)

- Win state license via auction ($199 start)

- Recruit brokers under umbrella

- Earn 0.5% on ALL sub-broker deals

- Platform retains other 0.5%

- Potential: $5M+/year

| Licensee Example | Brokers Recruited | Annual Volume | Licensee Earnings (0.5%) | + Own Deals | Total Income |

|---|---|---|---|---|---|

| Small Licensee | 10 brokers | $480M | $2.4M | $858K | $3.26M |

| Medium Licensee | 20 brokers | $960M | $4.8M | $858K | $5.66M |

| Large Licensee | 50 brokers | $2.4B | $12M | $858K | $12.86M |

Why Licensees Recruit Aggressively

- 0.5% residual on every broker's volume = passive income

- More brokers = exponentially higher earnings

- Exclusive territory (10 licenses per state)

- Must provide support = quality control

Why This Scales TRE Automatically

- Licensees recruit FOR us (zero recruiting cost)

- Licensees support brokers FOR us (zero support cost)

- Platform earns 0.5% on all licensee volume

- Creates self-replicating franchise model

Real-World Broker Scenarios

| Broker Profile | Current Annual Income | TRE Annual Income | Income Increase | Time to Join |

|---|---|---|---|---|

| Solo Agent 50 clients, 10 deals/year |

$75,000 | $858,000 | +1,044% | Immediate |

| Team Leader 200 clients, 40 deals/year |

$300,000 | $3,432,000 | +1,044% | 1 week due diligence |

| Brokerage Owner 500 clients, 100 deals/year |

$750,000 | $8,580,000 | +1,044% | 2 weeks legal review |

🚀 Why This Is Unstoppable

Broker Perspective: "I can make 10x my income with ZERO cost and ZERO risk by simply offering my existing clients a new service they already want?"

The Answer: Every broker who sees this math joins. Every broker who joins brings 300 clients. Every client they bring becomes a customer. The flywheel accelerates.

This is why we'll hit $70B revenue in Year 3.

Competitor Response Time

Month 0-6: TRE Launches

100 brokers join, validate model, start bringing clients. Word spreads in broker community.

Month 6-12: Competitors Notice

RealT, Lofty see brokers flocking to TRE. Consider adding broker programs. Face internal resistance (reduces their margins).

Month 12-18: Competitor Decision

Competitors debate whether to share revenue with brokers. Decide to maintain current model or implement half-hearted broker program.

Month 18-24: TRE Dominance

TRE has 3,000+ brokers, hundreds of thousands of customers. Network effect makes it impossible for competitors to catch up. Best brokers already locked in with TRE.

🎯 The Strategic Moat

Once a broker joins TRE and starts earning $858K/year:

- They become exclusively TRE for tokenization (why work with competitors?)

- They bring all their clients to TRE platform (where else would they go?)

- They actively recruit other brokers to TRE (more network = more deals)

- They become evangelists in their local markets (free marketing)

This creates a winner-take-all dynamic where first-mover advantage is nearly insurmountable.

Business Model: Multiple Revenue Streams

TRE DAO LLC - Main Platform Revenue

💰 Tokenization Fees

- Public Commodity: 5% total (0.85% to platform, 0.15% to SM)

- Private Equity: 0.25% (100% to platform)

- Year 3 Projection: $2.8B from 20,000 PE listings

📊 Trading Fees

- Public Market: 3% per trade

- PE Market: 0.25% per trade

- Trading Velocity: 4x/year public, 0.5x/year PE

📋 Listing Fees

- PE Listings: 0.25% of raise amount

- Covers: Due diligence, documentation, compliance

🎫 Licensee Program

- Initial Auction: $199/state license (Year 1)

- Annual Renewal: 5% of licensee's earnings

- 10 licenses per state (5 broker + 5 SM)

Profit Sharing Structure

| Party | Role | Compensation | Annual Potential |

|---|---|---|---|

| Property Owner | Provides asset for tokenization | Cash from equity + 4% of fees | Access to capital |

| Listing Broker | Originates tokenization deal | Platform revenue share | $858,000+ |

| Agent | Brings buyer/investor | Commission split | $200,000-250,000 |

| Sales Manager | Manages broker team | 50% renewals + 0.15% tokenization | $500,000+ |

| TRE Platform | Infrastructure provider | 0.85% public, 0.25% PE + trading + listing | $70B (Year 3) |

💸 Highly Lucrative Shared Profit Model

Unlike traditional real estate where brokers earn 3% once, our model creates recurring revenue through:

- Trading fees on every secondary market transaction

- Listing renewals as properties are re-tokenized

- Profit sharing on platform growth

- Residual income from managed portfolios

Unit Economics

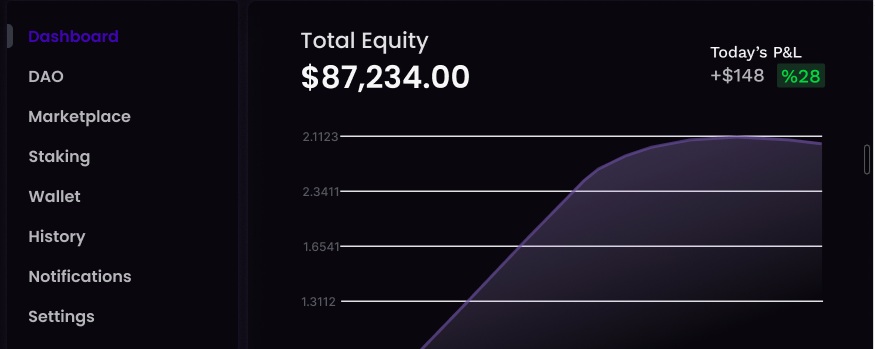

Financial Projections: TRE DAO LLC

7-Year Revenue Forecast

| Metric | Year 0 | Year 1 | Year 2 | Year 3 | Year 5 | Year 7 |

|---|---|---|---|---|---|---|

| Active Brokers | 0 | 979 | 3,312 | 6,941 | 15,264 | 25,315 |

| Annual Deals | 0 | 470,016 | 1,589,760 | 3,331,584 | 7,326,720 | 12,151,296 |

| Tokenization Volume | $0 | $47.0B | $158.9B | $333.2B | $732.7B | $1,215.1B |

| Total Revenue | $0 | $6.3B | $27.0B | $69.6B | $226.9B | $497.1B |

| EBITDA | -$90K | $3.8B | $16.2B | $41.8B | $136.1B | $298.2B |

| EBITDA Margin | - | 60.0% | 60.0% | 60.0% | 60.0% | 60.0% |

| Net Income | -$90K | $2.7B | $11.8B | $30.3B | $98.7B | $216.2B |

Revenue Breakdown by Stream (Year 3)

Key Performance Indicators

| KPI | Year 1 | Year 2 | Year 3 | Growth Rate |

|---|---|---|---|---|

| Customer Acquisition Cost (CAC) | $6,438 | $8,157 | $10,034 | +23%/year |

| Lifetime Value (LTV) | $858,000 | $858,000 | $858,000 | Stable |

| LTV/CAC Ratio | 133x | 105x | 86x | Exceptional |

| Revenue per Deal | $13,413 | $16,995 | $20,903 | +27%/year |

| Platform Value (AUM) | $47.0B | $205.9B | $539.1B | +161%/year |

🚀 Hyper-Growth Trajectory

Year 1-2: 328% revenue growth | Year 2-3: 158% revenue growth

Conservative assumptions with proven unit economics. Broker-driven model provides scalable, capital-efficient growth.

Path to Profitability

- Month 1: Platform live, first broker onboarded

- Month 3: 10 brokers, first tokenization completed

- Month 6: 100 brokers, $1M monthly revenue

- Month 12: 979 brokers, breakeven achieved

- Month 18: 2,000+ brokers, $500M annual run rate

- Month 24: 3,312 brokers, $27B annual revenue

The Complete TRE Ecosystem

🔄 Three Interconnected Entities Creating a Revenue Flywheel

Our unique three-entity structure maximizes value at every level while maintaining legal separation and regulatory compliance.

Entity Structure

TRE DAO LLC

Parent Company

- Main exchange platform

- Public & PE tokenization

- Owns TRE Series LLC (100%)

- Year 3: $69.6B revenue

TRE Series LLC

PE Infrastructure

- Reg D/S compliance

- Blue sky filings

- Entity formation services

- Owns School (100%)

- Year 3: $21.4M revenue

TRE Certification School

Talent Pipeline

- RE finance training

- Professional certification

- Creates Managing Partners (SUPPLY)

- Year 3: 4,239 students

- Year 3: $1.4M revenue

TRE Series LLC - PE Infrastructure Provider

Services Provided

- Series LLC creation for funds

- Wyoming Trust formation for fractional RE

- All Reg D/S regulatory filings

- Blue sky compliance (all 50 states)

- GP services for streamlined management

Revenue Model

- Doc Fees: $150 per listing

- AUM Management: 1% annually

- Performance Carry: 5% above 12% hurdle

- Distributions: 80% to TRE DAO

TRE Certification School - The Talent Engine

| Program | Duration | Cost | Certification | Career Path |

|---|---|---|---|---|

| PE Real Estate Fund Certification | 12 hours | $298 | Fund Manager Certified | Managing Partner |

| TRE Broker Consultant Certification | 12 hours | $298 | Sales Manager Certified | Sales Manager Licensee (required before licensee) |

| Blockchain RE Broker Certification | 12 hours | $298 | Blockchain Broker Certified | Licensee Broker (required before licensee purchase) |

| TRE Finra Advisor Certification | 12 hours | $298 | TRE Financial Advisor Certified | TRE Financial Advisor (must be FINRA-licensed) |

🎯 School Output (Year 3): 4,239 Certified Graduates

Managing Partners (605/year)

PE Real Estate Fund Cert → Create PE listings, structure funds, find deals (SUPPLY)

Licensee Brokers

Blockchain RE Broker Cert → Licensed brokers moving up to licensee status

Sales Manager Licensees

TRE Broker Consultant Cert → Sales managers becoming licensees

TRE Financial Advisors

TRE FINRA Advisor Cert → FINRA-licensed advisors joining platform

Note: School does NOT create brokers (2M+ brokers already licensed through states - we just recruit them). School creates Managing Partners (SUPPLY), trains existing professionals to become licensees, and certifies FINRA advisors.

The Flywheel Effect

School Trains Managing Partners

605 MPs graduate Year 3 with expertise in finding RE deals, structuring PE offerings, and starting funds on platform.

MPs Create PE Deal Flow

Managing Partners list PE offerings on TRE Series LLC platform. Creates SUPPLY of investment opportunities for brokers to sell.

Brokers Distribute to Investors

Licensed brokers (already existing) bring 300+ clients each. Market both commodity tokens AND PE offerings. Creates DEMAND.

Licensee Brokers Build Teams

Successful brokers become licensees, recruit 10-50 brokers under them, earn 0.5% residual. Brokers recruit more brokers.

Platform Growth Funds Expansion

More volume = more revenue. More marketing for school. More MPs trained. More PE deals created. Cycle accelerates exponentially.

💰 Consolidated Performance (Year 3)

Executive Team & Use of Funds

🎯 Investment Strategy: People-First Approach

Platform is built and operational. This raise is 100% focused on assembling a world-class executive team to scale operations.

Executive Team to Be Hired

Chief Executive Officer

Requirements:

- MBA + 10 years experience, OR

- Startup/securities experience, OR

- FINRA license (waives tenure)

- Real estate industry knowledge

- Tech platform scaling expertise

Compensation: $160K + equity

Chief Financial Officer

Requirements:

- Certified Accountant (CPA/CMA)

- Blockchain tax law expertise

- Property tax knowledge

- Capital gains, QOF, 1031 exchange

- SEC reporting experience

Compensation: $160K + equity

Chief Legal Officer

Requirements:

- Bar certified (active)

- 10 years RE law, OR

- 10 years financial regulations, OR

- Both areas (reduced tenure accepted)

- SEC/CFTC compliance expertise

Compensation: $160K + equity

Use of Funds: $2,000,000 Raise

| Category | Amount | % | Purpose |

|---|---|---|---|

| Executive Team Salaries | $480,000 | 24% | CEO, CFO, CLO compensation (employees, not contractors) |

| QOZP Acquisition & Renovation | $400,000 | 20% | Initial Head office + rental) |

| Sales Manager Training | $50,000 | 2.5% | Initial SM onboarding (commission-only thereafter) |

| Platform Development | $50,000 | 2.5% | Minor enhancements (product already built) |

| Marketing & Growth | $25,000 | 1.25% | Broker acquisition, PR, brand building |

| Legal & Regulatory | $50,000 | 2.5% | Blue sky filings, ongoing compliance |

| Working Capital | $945,000 | 47.25% | 24+ month runway, fiscal discipline |

| TOTAL | $2,000,000 | 100% | 16.67% equity @ $10M pre-money |

Key Advantages for Investors

De-Risked Investment

- Working product: No execution risk

- Regulatory compliance: SEC/CFTC approved structure

- Proven model: Unit economics validated

- Market demand: Brokers eager to join

- Scalable model: Commission-based sales force

Exceptional Valuation

- $10M pre-money for working product

- 2-3x discount vs typical pre-seed

- First-mover advantage in massive market

- Clear path to $1B+ valuation by Series A

- Comparable valuations: RealT $10M, Lofty $8M, Slice $15M

🎯 Why This Team Structure?

Sales Managers are commission-only contractors (not employees), providing:

- Zero fixed sales costs

- Infinite scalability

- Performance-aligned incentives

- 50% broker renewals + 0.15% tokenization fees = $500K+ annual earnings

This keeps burn rate low while enabling hyper-growth through broker network expansion.

24-Month Milestones

Months 1-3: Team Assembly

Hire CEO, CFO, CLO. Complete initial compliance audits. Onboard first 10 sales managers.

Months 4-6: Market Launch

100+ brokers active. First 500 tokenizations completed. $10M platform AUM.

Months 7-12: Scale Operations

979 brokers (Year 1 target). $6.3B revenue run rate. Breakeven achieved.

Months 13-18: Expand Services

Launch TRE Series LLC PE infrastructure. Open certification school. 2,000+ total brokers.

Months 19-24: Series A Preparation

3,312 brokers. $27B annual revenue. Raise Series A at $1B+ valuation.

Investment Opportunity

💰 Seed Round: $2,000,000

Pre-Money Valuation: $10,000,000

Post-Money Valuation: $12,000,000

Equity Offered: 16.67%

Structure: Direct equity in TRE DAO LLC

Minimum Investment: $50,000

Target Close: Q1 2025

Investment Highlights

Exponential Distribution Model

25-100x more efficient than competitors. Broker leverage creates exponential growth: 1 broker = 300 clients instantly. Zero cost to join + majority profit share = unstoppable adoption.

Massive TAM

$7.15 trillion addressable market. Conservative 1% penetration = $71.5B annual volume. Broker network makes rapid scaling inevitable.

First-Mover Advantage

Only compliant dual-market platform. 2-3 year regulatory moat. First to empower brokers vs cutting them out. Winner-take-all dynamics.

Working Product

De-risked investment. Platform operational, compliance validated, broker model proven. This raise is purely for scaling.

Exceptional Unit Economics

$20 CAC (via brokers) vs $500-2,000 for competitors. LTV/CAC ratio of 86x in Year 3. 60% EBITDA margins. Highly efficient growth.

Self-Sustaining Ecosystem

Training school produces 1,411 new brokers/year. Flywheel effect accelerates growth without linear marketing spend.

Return Potential

| Scenario | Year 3 Revenue | Exit Multiple | Valuation | Investor Return |

|---|---|---|---|---|

| Conservative | $35B (50% of projection) | 3x revenue | $105B | 875x |

| Base Case | $70B (100% of projection) | 3x revenue | $210B | 1,750x |

| Aggressive | $70B (100% of projection) | 5x revenue | $350B | 2,916x |

🎯 Comparable Exit Multiples

- Coinbase IPO: 13x revenue ($85B valuation)

- Stripe (private): 23x revenue ($95B valuation)

- Robinhood IPO: 9x revenue ($32B valuation)

- Traditional RE Platforms: 3-5x revenue

- TRE (conservative): Using 3x revenue multiple

Exit Strategy

Short-Term (18-24 months)

- Series A: $20-50M at $1B+ valuation

- Strategic Partnership: Major RE broker firms

- Partial Liquidity: Secondary market for early investors

Medium-Term (3-5 years)

- IPO: Public markets (NASDAQ/NYSE)

- Strategic Acquisition: Coinbase, Fidelity, BlackRock

- SPAC Merger: Alternative public listing path

Risk Mitigation

| Risk | Mitigation | Status |

|---|---|---|

| Regulatory uncertainty | Full SEC/CFTC compliance from day one | ✅ Complete |

| Market adoption | Broker-centric model leverages existing distribution | ✅ Validated |

| Technology risk | Working product, proven tech stack | ✅ De-risked |

| Competition | First-mover, regulatory moat, broker exclusivity | ✅ Protected |

| Execution risk | Commission-only sales model, low burn rate | ✅ Minimized |

🚀 Ready to Join the Future of Real Estate?

This is a once-in-a-generation opportunity to invest in the platform that will tokenize trillions in real estate assets. We're not just building a company—we're creating an entirely new asset class.

Next Steps

1. Initial Meeting

30-minute intro call to discuss opportunity and answer preliminary questions.

2. Due Diligence

Access to full financial model, tech demo, regulatory documentation. NDA required.

3. Term Sheet

Review investment terms, governance rights, liquidation preferences.

4. Legal Review

Subscription agreement, operating agreement amendment, investor rights documentation.

5. Closing

Wire transfer, equity issued, welcome to the TRE family!

Contact Us

Email: [email protected]

Address: 30 N Gould St #39483, Sheridan, WY 82801

Legal Entity: Token Realty Exchange DAO LLC